In June 2019, a cyclical growth is estimated for exports (+1.2%) and a decrease for imports (-2.1%). The cyclical increase in exports is determined by the increase in sales to non-EU markets (+3.9%) while those to EU countries are decreasing (-1.0%).

In the second quarter of 2019 there was a cyclical increase for both foreign trade flows, more intense for exports (+1.7%) than for imports (+1.2%).

In June 2019, the decrease in exports on an annual basis is equal to -3.5% and is determined by the decrease in sales recorded both for the EU area (-4.6%) and for the non-EU area (-2.1%). Similarly, imports decreased (-5.5%) both from the EU area (-6.1%) and from non-EU markets (-4.7%).

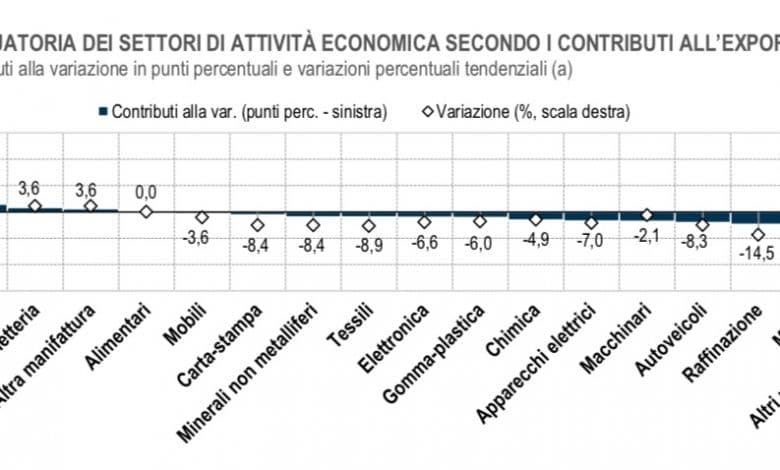

The sectors that contribute to the downward trend in exports include means of transport, excluding motor vehicles (-26.4%), base metals and metal products, excluding machinery and plants (-5.9%),  refined petroleum products (-14.5%) and motor vehicles (-8.3%), while in the same month the pharmaceutical, chemical-medicinal and botanical articles (+34.5%), especially in the United States

refined petroleum products (-14.5%) and motor vehicles (-8.3%), while in the same month the pharmaceutical, chemical-medicinal and botanical articles (+34.5%), especially in the United States

On an annual basis, the countries that contribute most to the decrease in exports are Germany (-8.0%), Switzerland and OPEC countries (-13.5% for both), and France (-3.8%), while there is an increase in sales to the United States (+4.1%) and Japan (+27.9%).

In the first six months of 2019, the year-on-year increase in exports (+2.7%) was mainly driven by sales of pharmaceutical, chemical-medicinal and botanical articles (+28.0%), textiles and clothing, leather and accessories (+7.3%), food, beverages and tobacco (+6.9%).

It is estimated that the trade surplus will increase by 554 million euros (from +5,174 million in June 2018 to +5,728 million in June 2019). In the first six months of the year the trade surplus reaches +22,107 million (+42,414 million net of energy products).

In June 2019, the import price index is estimated to decrease by 1.4% in cyclical terms and by 1.6% compared to the same month of the previous year. In both cases, the dynamics are substantially stationary net of energy.

FULL TEXT AND METHODOLOGICAL NOTE

INDUSTRY TURNOVER AND ORDERS

In June it is estimated that the turnover of the industry will decrease by 0.5% in quarterly terms. In the second quarter, the overall index decreased by 0.1% compared to the previous quarter.

Orders also recorded a cyclical decline in June both on a monthly basis (-0.9%) and overall in the second quarter (-0.4%).

With reference to the manufacturing sector, the textile and means of transport industries recorded the trend growth of the most significant turnover (+4.1%), while the pharmaceutical industry shows the greatest drop (-12.6%).

In tendential terms, the raw index of orders fell by 4.8%, with decreases on both markets, but of notably different extents: -1.8% on the domestic market and -9.1% on the foreign market. The greatest trend growth is recorded in the means of transport industries (+5.1%), while the worst result is seen in the pharmaceutical industry (-16.2%).