The derivative instrument or simply derivative (in English derivative) in finance is a contract or security whose price is based on the market value of another financial instrument, defined as the underlying (such as, for example, shares, financial indices, currencies, interest rates or even commodities).

The main uses of derivative instruments are the hedging of a financial risk (called hedge), arbitrage (i.e. buying a product in one market and selling it in another market) and speculation.

Derivatives are therefore hedges for complex risks that cannot be standardized such as those of insurance policy claims, and although the logic is very close to that of insurance companies, they have in themselves the concept of a large gain if the values derived from the original contract turn out to be better in the future. sense of those who buy the uncertainty of a future derived value. These financial instruments have countless applications and in most cases have had hugely profitable implications.

Derivatives are therefore hedges for complex risks that cannot be standardized such as those of insurance policy claims, and although the logic is very close to that of insurance companies, they have in themselves the concept of a large gain if the values derived from the original contract turn out to be better in the future. sense of those who buy the uncertainty of a future derived value. These financial instruments have countless applications and in most cases have had hugely profitable implications.

Think of the pharmaceutical industry, which has contributed so much to improving our quality of life in recent decades, extending life expectancy thresholds above 80 years, an unthinkable result until a few years ago. Not everyone knows that progress in the healthcare and pharmaceutical fields can be attributed to a significant extent to the use of derivatives in finance.

The big pharmaceutical companies have always had a multiplicity of research projects to develop and for each of them the objective of arriving at a drug capable of generating economic income. But this is a difficult point of arrival that can be reached after decades with the fortunate investment of hundreds of millions of dollars, in some cases even billions of dollars.

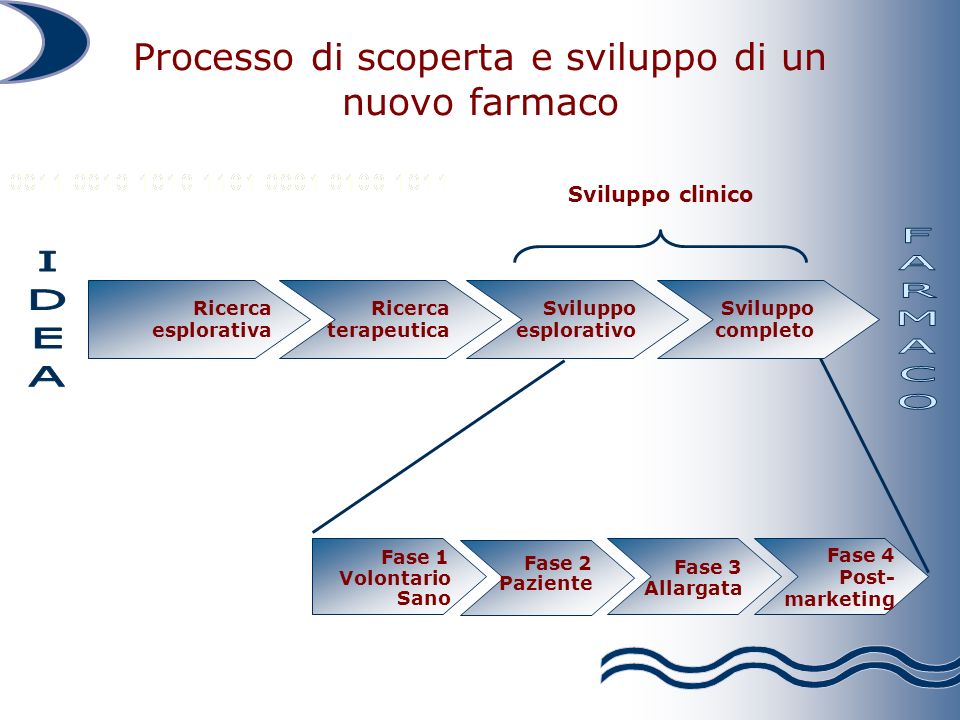

To obtain an active ingredient that is useful in medicine and therefore in an economic sense, pharmaceutical companies must secure huge bank loans for their business plans which are generally implemented in 5 phases, initially totally uncertain and risky. The first phase of a business plan for the development of a pharmaceutical/health product sees only pure research to be done; then there is a second phase of technical realization and fine-tuning of the active principle capable of signifying an answer to what has been found in the research: therefore there is

a third phase of long and expensive experimentation, followed by a phase of scientific approval State by State, which ends with a fifth marketing phase aimed at promoting the product.

Each of these phases generally costs hundreds of millions of dollars and it is said that by focusing on some research projects we will pass from one phase to another and finally arrive at something good, while by focusing on others we will not get there. In reality, bankers are in the dark in terms of seeing when to become a partner of a given multinational on certain projects, and when not, going overboard with loans that can blow up a given pharmaceutical company and therefore create heavy losses also for the bank or partner fund.

Derivatives have intervened in this system by allowing banks to finance the first step of many more business plans in research than in past years, thanks to the artifice of securitize (transform the debt into a bond) and sell risks that a research phase of hundreds of millions of dollars does not produce any hypothesis of economic result, but proposing the realistic possibility that through it we arrive at an active principle capable of generating flows of billions of dollars.

In this way, if a pharmaceutical company could first roll the dice with 3 or 4 research projects, with the risk of arriving at nothing and therefore going into crisis in the following decades, with the introduction of derivatives alongside funding, i.e. sharing the risks and the great expectations of earnings with the financial market, the same pharmaceutical company was able to give rise to the first steps of 30 different research projects, thereby multiplying the possibilities of development, earnings and achieving the best well-being for all, because searching for something good in more areas is easier to find and create.

Taken from Imola Oggi Italexit Away from the disaster of derivatives – 10 December 2018