On Wednesday morning, the resolution on the obligation to accept payments also via debit cards was approved in the VI Finance Commission of the Chamber of Deputies.

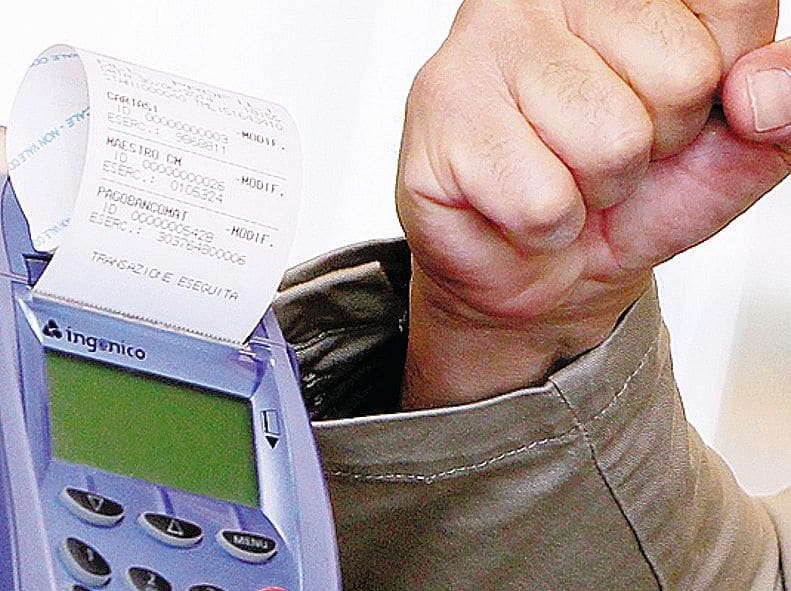

From a minimum of 25-60 euros per year up to a maximum of 120-180 euros: this is the average cost that a professional, as well as a commercial establishment, must bear to acquire a Pos. The data emerged from a table set up a few days ago by the Ministry of Economic Development with Bank of Italy and credit institutions.

For about a month now, professionals and traders have been obliged to accept payments in electronic money if the customer requests it and if the purchases or services exceed the minimum value of 30 euros. It is therefore not a novelty, but there was a need to clarify the costs of the service and the ministerial table responded to this objective. There are two types of costs: fixed and variable. The fixed costs are linked to the device itself and are determined by the technology used for the connection and the functions that the workstation is able to offer. The number and amount of transactions carried out and the type of circuit used affect variable expenses. In the meantime, the decree of the Ministry of Finance has entered into force which urges banks issuing credit and debit cards to make transparency regarding the interbank fees applied to payment transactions. The comparability of commissions must also be guaranteed; the tariffs must be periodically reviewed (at least annually) in relation to the volume and value of the transactions.

Finally, on Wednesday morning, the resolution on the obligation to accept payments by debit card was approved in the VI Finance Commission of the Chamber of Deputies. The resolution commits the government to ensure a reduction in the fixed costs of the POS terminal, possibly also through forms of tax exemption that contemplate the recognition of a tax credit.

Renato Torlaschi

Friday, 01 August 2014 -. Doctor33

The family doctor «Another joke»

Legislative Decree 179/2012 art.15

TO