In compliance with the provisions of art. 11, paragraph 6, of Legislative Decree no. 78/2010, converted, with amendments, into Law no. 122/2010 and subsequent amendments, relating to the attribution of the burden to be borne by pharmaceutical companies,  calculated on the retail price net of value added tax of medicines supplied under the National Health Service, Pharmaceutical companies are hereby informed that the Online Services platform dedicated to the agreed Pay-back procedure 1.83% II semester 2020 will be active from 16.00 today.

calculated on the retail price net of value added tax of medicines supplied under the National Health Service, Pharmaceutical companies are hereby informed that the Online Services platform dedicated to the agreed Pay-back procedure 1.83% II semester 2020 will be active from 16.00 today.

After entering their access credentials, these marketing authorization holder companies can select the link to "Pay-back Convention II semester 2020", in order to view the list of products for which the companies themselves can make use of the pay-back procedures and the corresponding quantification of the amounts that will have to be paid to the Regions by 17 May 2021. Please note that the payment slips certifying the effective payment of the amounts due must be sent via the "Pay-back Conventioned II semester 2019" platform by 24 May 2021.

Any communication concerning the procedure must be sent to the PEC address: areastrategiaeconomiadelfarmaco@pec.aifa.gov.it and to the MAIL address payback1.83@aifa.gov.it

It should be noted that the amounts relating to the 5% payback procedure for the year 2020 possibly paid by pharmaceutical companies will be taken into consideration in this proceeding.

It should also be noted that the amounts have been calculated net of VAT to allow correct payment to the Regions.

Therefore, pursuant to the provisions of art. 1, paragraphs 394 and following of the budget law for the year 2018 (Law 205/2017), companies that intend to deduct VAT must make a further payment to the Treasury for an amount equal to said tax, without the possibility of compensation, with the methods indicated in article 17 of legislative decree 9 July 1997 n. 241.

To this end, upon expiry of the deadline set for 22 May for the payment to the Regions of the amounts net of VAT, AIFA will inform them of the aforementioned amounts gross of VAT by means of publication on the dedicated front-end.

It should be noted that this further publication of the amounts gross of VAT will replace the previous publication of those net of VAT

Interested companies are therefore invited to keep the data relating to the amounts net of VAT before the new publication.

This note is valid, for all legal purposes, as a communication of the initiation of the proceeding pursuant to articles 2, 7 and following. L. no. 241/90 and subsequent amendments and additions. It is made available here, in accordance with the principles of transparency and publicity pursuant to Law no. 241/1990 and subsequent amendments and additions. and Legislative Decree n. 33/2013 and subsequent amendments, the methodological document, which represents the useful tool for interpreting the pay-backs attributed to each individual holder, also published in the dedicated Front-End section together with all the data and deeds referred to therein.

AIFA – Published on: 06 May 2021

PDF Methodological Note [0.48 Mb] >

The payback mechanism in Italy

The payback mechanism was introduced for the first time in Italy with the 2007 Budget Law and allows the disbursement of economic resources to the Regions in support of their pharmaceutical expenditure and allows the containment and consumption control from the pharmaceutical expenditure in Italy. The payback mechanism has been used on multiple occasions over the years. Below are some of the most relevant to the pharmaceutical companies:

Payback 5% Law of 27 December 2006, n. 296 art. 1, paragraph 796, letter g (Finance Act 2007)

Payback 5% Law of 27 December 2006, n. 296 art. 1, paragraph 796, letter g (Finance Act 2007)

The AIFA Resolution n. 26 of 27 September 2006 provides for a reduction of 5% on the public price including VAT of medicines reimbursable by the NHS. The payback mechanism in this case it is used to allow the pharmaceutical companies to request AIFA to suspend the reduction in the price of the 5% of the medicines it owns, against the payment to the Regions of the amount equivalent to the aforementioned reduction.

This amount must be paid by the pharmaceutical companies in a single annual installment. This mechanism allows pharmaceutical companies to make choices on the prices of the drugs they own, based on the market strategies decided and planned by the companies themselves.

Recently, AIFA proposed the inclusion in the next Budget Law of the abrogation of this payback, both for a question of administrative simplification and for a lack of economic benefits for the NHS.

Specialized payback (or 1.83% payback)

The 1.83% payback was introduced pursuant to art. 11, paragraph 6, of Legislative Decree 78/2010 converted with amendments into Law no. 122 of 30 July 2010, and further amended on the basis of the provisions of art. 2, paragraph 12-septis, of Legislative Decree no. 225 of 29 December 2010, converted, with amendments, by Law no. 10 of 26 February 2011).

This type of payback provides for the payment to the Regions by the pharmaceutical companies of the amounts corresponding to a share of 1.83% of the retail price of their medicines dispensed paid by the National Health Service, provided under an agreement. The amounts must be paid to the Regions, on the basis of the tables prepared by AIFA, in two six-monthly installments (the first relating to the period 1 January – 30 June and the second relating to the period 1 July – 31 December).

Payback Law 222/2007 and Law 135/2012 (Pharmaceutical Expenditure Shelf)

This last payback procedure foresees the shelf of thepharmaceutical expenditure surplus by each Marketing Authorization Holder of medicines reimbursed by the NHS. Initially this mechanism was introduced (article 5 of the decree law 159/2007, subsequently converted into Law 222/2007) for the shelf of the solo territorial pharmaceutical expenditure and subsequently it was also extended to hospital pharmaceutical expenditure (article 15, paragraph 8, of decree law 95/2012 converted into law 135/2012).

There hospital pharmaceutical expenditure it was subsequently amended with the Law of 11 December 2016 n. 232 (Budget Law 2017) also including class A medicines supplied in direct distribution and on behalf. This has led to the redefinition of hospital pharmaceutical expenditure in "pharmaceutical expenditure for direct purchases".

The mechanism provides that, in case of overcoming of the national pharmaceutical spending cap, companies must pay off the surplus through payments to the Regions of the amounts attributed by AIFA to each individual company.

The mechanism initially envisaged the reimbursement of expenditure by pharmaceutical companies in proportion to their contribution to breaking through the ceiling on the basis of company budgets assigned by AIFA. With the new Budget Law 2019However, the contribution of each company is no longer calculated on the basis of company budgets, but by a system based on market shares which has led to a simplification of the entire process.

Written by: Flavia Salvaggio for Di Renzo Regulatory affairs

_____________________

Considerations

Does a company sell too much? Must return part of the proceeds. In a logic of market economy its unjust absurdity is clear. But as it is structured in pharmaceuticals, again from a doctrinal perspective, it also clashes in a context of a planned economy, in which it settles only where it is most convenient, i.e. on supply, leaving demand with little control, so as to save on spending but consuming almost freely beyond the ceilings, but at the expense of others.

In other words, the payback requires an ex post account of consumption that exceeds the planned one, placing the “blame” of inflating the demand on the offer, not taking into account that the therapy strictly follows the need for care. Instead, the industry is held responsible and therefore punishable (payback).

In other words, the payback requires an ex post account of consumption that exceeds the planned one, placing the “blame” of inflating the demand on the offer, not taking into account that the therapy strictly follows the need for care. Instead, the industry is held responsible and therefore punishable (payback).

The payback-cap system embodies the typical contradiction of the pharmaceutical industry in having to make the market economy of the economic-productive sectors coexist with the planned economy of public spending.

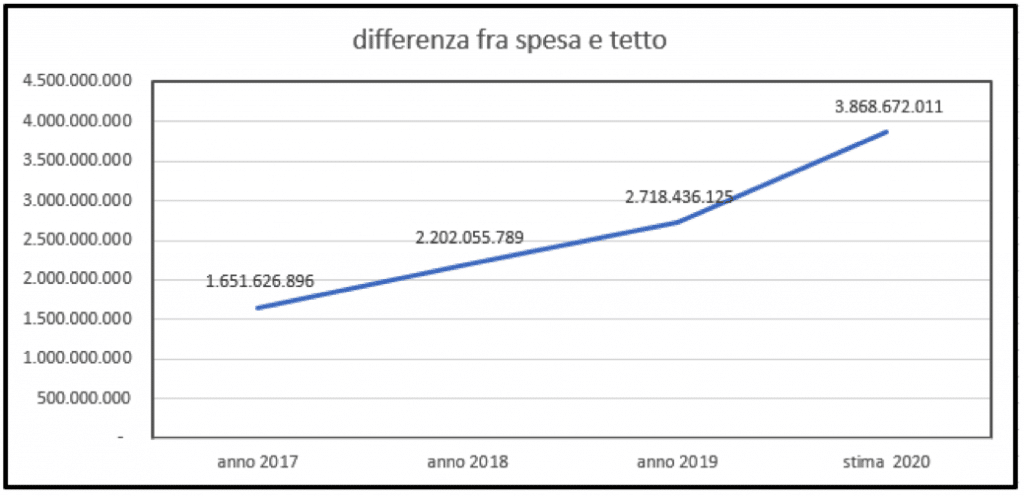

Spending ceilings for pharmaceuticals are always underfunded. Despite the planned increase in 2021 for the spending ceiling for direct purchases, pharmaceutical spending still remains underfunded. It is improper to set such a low ceiling on pharmaceutical expenditure when it is known that it will be breached by more than two billion euros.

Direct pharmaceutical spending continues to go overruns also because many drugs that were previously prescribed at a local level and purchased in pharmacies have switched to the direct channel for a simple cost reason: at the hospital level, tenders are then held on prices already negotiated with AIFA (prices that are already among the lowest in Europe) and competitions are held on drugs that are not hospital drugs but drugs that should be in the contract

Pharmaceutical expenditure for direct purchases (hospital expenditure) in 2020 once again exceeded the ceiling set by law. In fact, according to calculations, the deficit on drug spending is around 2.7 billion euros, of which 1.35 billion will have to be paid off by pharmaceutical companies.

companies have to repay, with the payback system, half of the NHS drug deficit. The remainder is paid by the individual Regions on the basis of their exceeding the assigned budget

The pay-back does not only affect the pharmaceutical companies, but also pharmacies and wholesalers and in the event of an overrun, the burden is spread over the entire supply chain.