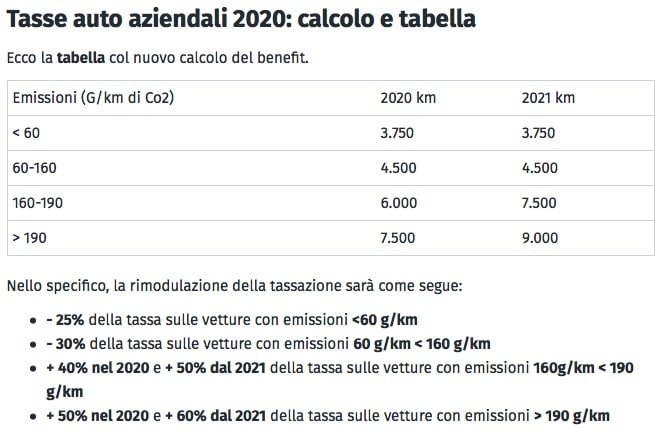

With the rresolution 46/E of 14 August the Revenue Agency has provided the expected clarifications regarding the changes in the 2020 budget law on fringe benefits for company cars (see also Il Sole 24 Ore of 15 August). Law 160/2019 in fact innovated the criterion, to be applied from 1 July, for quantifying the tax and social security value of company cars assigned to employees for mixed use by providing for four variable values based on the level of CO2 emissions, instead of the single flat rate previously in force.

In the case of signing of the assignment agreement between the parties (employer and employee) after 1 July 2020 and enrollment after that date, the new discipline established by the Budget Law 2020 (flat rate adjustment based on CO2 emissions into the atmosphere); if, on the other hand, the registration was prior and the assignment as well, the old legislation continues to be applied (the flat rate of the 30% for all types of vehicles). Finally, if the assignment is after 1 July 2020 and the registration is prior, it is necessary to separate the private use of the vehicle (to be documented objectively) from the normal value, to avoid taxing the entire value for the employee (Video pill August 18, 2020)

Corporate welfare: doubled the non-taxable limit for Fringe Benefits

The August decree doubles the non-taxability of the corporate welfare limit, in particular of fringe benefits. Let's see better what it is.

Invest today – August 17, 2020

Given the extraordinary need and urgency to introduce measures aimed at mitigating the negative effects of the coronavirus health emergency, the August decree introduces new support and recovery measures

of the economy, as well as financial and fiscal measures to meet the liquidity needs of the companies most affected by this crisis.

of the economy, as well as financial and fiscal measures to meet the liquidity needs of the companies most affected by this crisis.

Pursuant toarticle 112, decree law 14 August 2020, n. 104, limited to the 2020 tax period, the amount of the value of the goods sold and services provided by the company to employees that does not contribute to the formation of income (Fringe Benefit) is doubled compared to the standard limit.

Fringe Benefits, what is it about?

Fringe benefits are among the main resources available to employers to create corporate welfare and boost the productivity of their employees. In other words, they represent a form of remuneration in kind which does not contribute to the formation of the income of the recipient.

Examples of fringe benefits are:

- meal vouchers or company canteen;

- accommodation in apartments or hotels;

- business phone; PCs, tablets etc;

- cars or other means of transport;

- insurance policies.

- Even more.

Pursuant to art. 51, paragraph 3 of the Consolidated Law on Income Taxes: "The normal value of goods in kind produced by the company and sold to employees is determined in an amount equal to the average price charged by the same company in sales to the wholesaler. The value of the goods sold and of the services provided does not contribute to forming the income if the total amount does not exceed 500,000 lire (258.23) in the tax period; if the aforementioned value is higher than the aforementioned limit, the same contributes entirely to forming the income”.

August decree, doubled the non-taxability for Fringe Benefits

According to the provisions of thearticle 112 of the August decree, for 2020 only, the amount of the non-taxable limit on the value of Fringe Benefits is doubled, the new limit is equal to 516.46 euros, compared to the current 258.23.

Related news: Company cars, CO2-related tax for vehicles registered from 1 July

Company car taxes, from 1 July we change: calculation and tables